Become a UKFCU Member Today!

Joining UKFCU means you’re not just an account holder – you’re a valued member.

Trending Topics and Links

Become a UKFCU Member Today!

Joining UKFCU means you’re not just an account holder – you’re a valued member.

Unlock everyday value with BlueVantage Checking!

It's packed with benefits that go beyond the basics including:

Frequently Asked Questions

UKFCU's Routing/ABA number is 242176129.

Routing numbers identify the financial institution from and to which funds are transferred. They allow companies and individuals to know which specific financial institution has the account in question.

The negative balance should be paid within 30 days. If you need assistance, please contact us and ask for Member Solutions.

If you have a problem or question, please feel free to contact the Credit Union. We can be reached during regular business hours (Monday-Friday: 9:00 a.m. to 6:00 p.m. and Saturday: 9:00 a.m. to 1:00 p.m.), by calling 859-264-4200 or 800-234-UKCU (8528), or in person at one of our branch locations, or by email at contact@ukfcu.org*.

*Please Note: E-mail is not a secure means of communication, and confidential information should not be conveyed.

Online and Automated Services

Log on to your account with Online Banking or retrieve account information with self-service telephone banking.

Loan payments can be made with:

Credit Card payments can be made with:

You can access your credit card directly through Online Banking.

Credit Card Payment Cheat Sheet for Online and Mobile Banking

To pay your credit card using either Mobile or Online Banking, you will need to complete the following steps:

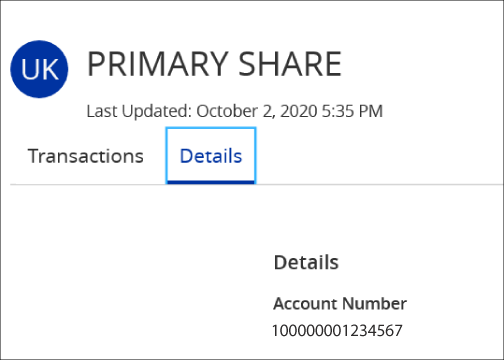

How do I find my account number?

If you need your account number, this can be found by clicking on your savings account tile on the home screen and selecting the "details" tab. From there, your full account number will be displayed.

Call Member Services at 859-264-4200 to have one ordered for you. You can also stop by any branch and they will instantly issue you a replacement.

We strongly encourage our members to travel abroad with a UKFCU debit card. This card will be accepted at the ATM, whether it is designed for cash advances or is a regular cash dispensing machine.

Placing a travel notice on your account(s) will help us differentiate whether you are on the road or if your account has been compromised. You can place a travel notice on your account in Online and Mobile Banking by visiting us at one of our branches, or by calling us at 859-264-4200.

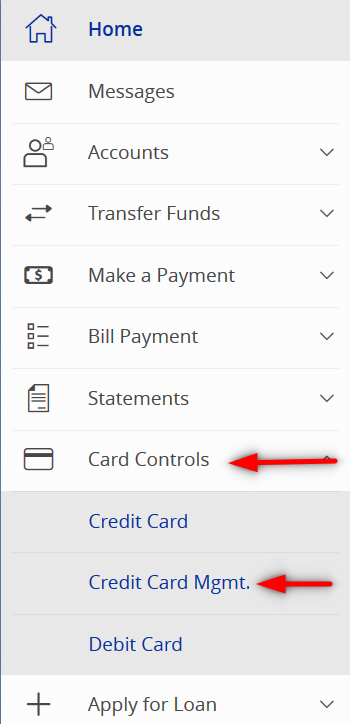

To place the travel alert through Online or Mobile Banking, select "Card Controls," and then select either your debit or credit card. From there, select the "Travel Notification" button and complete the requested information.

For security purposes the cardholder must contact us to resolve the issue.

We can be reached during regular business hours (Monday-Friday: 9:00 a.m. to 6:00 p.m. and Saturday: 9:00 a.m. to 1:00 p.m.) by calling 859-264-4200 or 800-234-UKCU (8528), or in person at one of our branch locations, or by email at contact@ukfcu.org*.

*Please Note: E-mail is not a secure means of communication, and confidential information should not be conveyed.

When you have an auto loan with UKFCU, it is required that you carry full coverage that includes comprehensive and collision for the value of the loan. If you need to provide UKFCU with your insurance information, you may upload your policy on the MyInsuranceForm portal. Please make sure your insurance provider has UK Federal Credit Union listed as the lien holder on your insurance policy.

As a member of the University of Kentucky Federal Credit Union, you get a discount at many businesses. Be sure to mention you are member in order to receive your discounts.

Some of those benefits include:

Protect your car and home with customized insurance from Liberty Mutual. We'll help you select the right coverage and get the discounts you're eligible for. We offer many ways to save based on important life events as well as Multi-Policy and Multi-Car Discounts. And as a University of Kentucky Federal Credit Union member, you could receive exclusive savings for even greater value.1

Call Joey Doom at 859-223-1313 or visit Liberty Mutual Auto & Home Insurance

Discount: 10% off to UKFCU members.*

We also can provide a discount on Renters insurance.

*Go to our member benefits page to learn more about the discounts you can receive as a member of UKFCU.

Yes, all properties secured by a mortgage require proof of homeowners insurance. If your property is located in a flood zone, we will require proof of flood insurance coverage. To discuss specifics regarding your property, contact us.

If you have a problem or question, please feel free to contact the credit union. We can be reached during regular business hours (Monday-Friday: 9:00 a.m. to 6:00 p.m. and Saturday: 9:00 a.m. to 1:00 p.m.) by calling 859-264-4200 or 800-234-8528, or in person at one of our branch locations, or by email at contact@ukfcu.org*.

*Please Note: E-mail is not a secure means of communication, and confidential information should not be conveyed.

You should contact a Mortgage Loan Originator to see if you can be pre-approved for a loan so that you know what price range you can afford, to evaluate the monthly costs of a mortgage and to see how much of a loan you can afford. The pre-approval will also give you some leverage when negotiating with the sellers.

UKFCU has joined with SWBC Mortgage to customize a mortgage loan that meets your needs and fits your budget.

Visit our mortgage page to learn more.

If you have been locked out of Online Banking, you must contact us. For your security, we will lock out anyone who is unsuccessful in multiple attempts to log into your account. We want to verify that it's you trying to access the account and will ask personal information to reset the account login information.

If you have a problem or question, please feel free to contact UKFCU. We can be reached during regular business hours Monday-Friday 9:00 a.m. to 6:00 p.m. and Saturday 9:00 a.m. to 1:00 p.m. by calling 859-264-4200 or 800-234-8528, in person at one of our branch locations or by email at contact@ukfcu.org*.

*Please Note: E-mail is not a secure means of communication, and confidential information should not be conveyed.

To enroll in Online Banking, click the Login button at the top right of any UKFCU webpage located in the top right section of our website (for mobile users, please press the hamburger menu at the top right of the screen and select "Login" from the resulting menu). From there, select the Member Enrollment button at the bottom of the screen and enter the required information.

You will then be sent a unique, one-time code. Once you have received and input the code, you will create your password. Make sure to register your device as you login so you don't have to complete the identity verification process each time you log into Online Banking.

For a step-by-step guide on how to complete the enrollment process, view our enrollment video tutorial here.

There are several ways to change your address:

UKFCU

1730 Alysheba Way

Lexington, KY 40509

In Person: You can always stop by a branch location and meet with us personally. Bring a photo ID, such as a driver's license for identification and a representative will be happy to update your information. Visit our locations page to find a branch near you.

Yes, you may stop by any of our branch locations for our notary services. There is no charge for members to use this service. Please bring along a photo ID.

Visit our locations page to find a branch near you.

Steps to Set Up Your Direct Deposit with UKFCU

The credit union does not have a SWIFT code. We have a routing number, which is 242176129.

We do accept international wires; however only Business Accounts offer external international wire transfers.

All international wires must come via a United States bank.

Routing numbers identify the financial institution from and to which funds are transferred. They allow companies and individuals to know which specific financial institution has the account in question. The routing number for UKFCU is: 242176129.

A routing transit number comes in the form of a nine-digit number that usually precedes the account number found at the bottom portion of checks.

Members may skip one loan payment, except on mortgages and credit cards, in a rolling calendar year for each loan they have with UKFCU. To get started, fill out the Skip-a-Pay form.

You may also skip a payment using Online and Mobile Banking. Go to the "Services" tab and select "Skip-a-Pay" and complete the required fields to skip your payment.

To be eligible:

A $29.00 fee will be charged when using Skip-a-Pay

With UKFCU’s Online Bill Pay, receive and pay your bills online with the click of a mouse. It’s simple, safe and guaranteed. To sign up for Online Bill Pay, follow the simple steps below:

And that's it! Now you're ready to use our Online bill Pay.

If you have never enrolled for digital banking services with UKFCU and are a business account rather than a personal or DBA account, enroll here. You’ll then enter all required information including your member number, TIN/EIN, business name, information about you, and your desired login ID.

Business accounts are not enabled immediately and require credit union review prior to approval. New business enrollments will be reviewed each business day and approved accordingly, but you may contact the UKFCU if you need access sooner.

To use UKFCU Mobile Banking, you need to be enrolled in Online Banking. You use the same username and password for both online and mobile banking.

Download our Mobile Banking app on the App Store or Google Play Store.

If you need help connecting your Intuit Account, please visit our Quicken and QuickBooks Support Page for a full list of details on how to convert your account to our online banking platform.

Starting August 1, 2023, UKFCU will no longer offer Gift Cards in our branches. Gift Cards will remain available for reloading until March 3, 2025. After that date, reloading will be discontinued, and on May 1, 2025, all remaining Gift Cards will be closed and balances refunded. If you have any questions, please reach out to UKFCU at 859-624-4200 for assistance.

Yes, emails from investsupport@accesssoftek.com are legitimate. Your BlueTrade account is managed by Access Softek Advisory Services, LLC and they will set up and manage the account based on the information you provide. This email address will also be your point of contact if you have any questions about your BlueTrade account.

Yes, you may receive text messages and letters requesting you upload additional insurance information through our portal at MyInsuranceInfo.

The insurance documentation you provide at loan opening does not typically include the vehicle you are purchasing. Once your new vehicle is added to your existing insurance policy, we will need a copy of the updated insurance declaration page. This can be uploaded through our insurance portal located at MyInsuranceInfo.com, or mailed to us at 1730 Alysheba Way, Lexington, KY 40509.

Open the Wallet App:

Add a New Card:

Scan Your Card:

Verify Your Card:

Set as Default (Optional):

Ready to Use:

Open the Google Wallet App:

Add a New Card:

Scan Your Card:

Verify Your Card:

Set Up for Payments:

Make it Default (Optional):

Once set up, you can conveniently use your digital wallet to make secure payments by simply tapping your phone at participating retailers!

Make payments today with PayPoint.

It's the easy way to pay your UKFCU loans or credit cards, even from an account at another financial institution.

Copyright 2026 University of Kentucky Federal Credit Union. Federally Insured by NCUA

Our website uses cookies to improve your website experience and provide more personalized products and services to you. By using our website, you agree to the use of cookies.

Log in below using your online banking credentials to open an account

You will need the following information in order to complete the application: